Myanmar's opposition National Unity Government held a soft launch Saturday of the Spring Development Bank, an online bank service and an important means to circumvent the military-controlled banking sector and raise funds to support the resistance to the junta.

The Spring Development Bank will face many hurdles in the war-torn country, including hacking and other attacks from the military regime, but the tech-savvy institution will also lay the groundwork for Myanmar’s future financial system.

Myanmar’s banking system grew considerably before the coup, but the sector was awash in non-performing loans. While many new banks emerged, many were tied to regime cronies and not professionally managed. There was a huge need for bank consolidation and recapitalization.

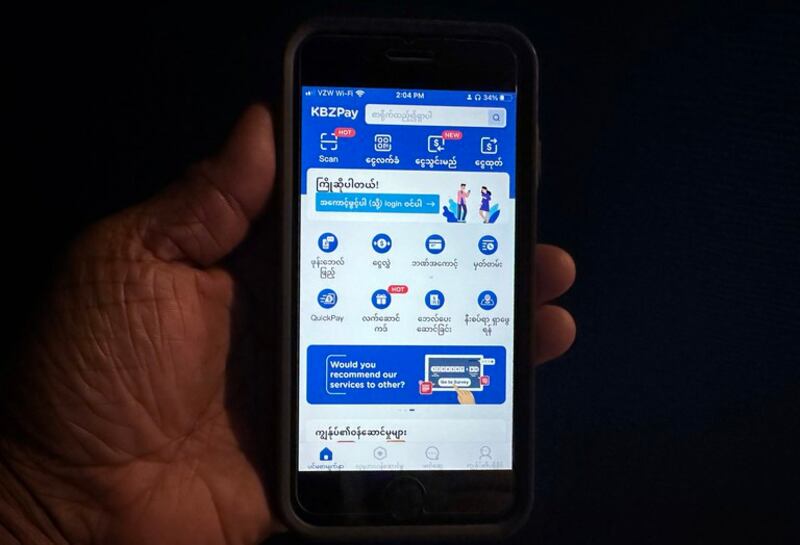

The exception to this was in the mobile banking sector, which took off and became indispensable for small businesses and farmers. There are seven different mobile payment systems, though two, Wave Money and KBZ Pay, dominate the market.

Immediately after the Feb. 1, 2021 coup, the junta briefly shut down mobile platforms because they were being used to channel donations to the civil disobedience movement, known as the Spring Revolution., and later to the opposition National Unity Government (NUG).

But they were too important to the economy, and the regime allowed them to reopen, though with considerable oversight and monetary limits on transactions. The regime has worked to tie mobile accounts to registered SIM cards, closed tens of thousands of anonymous accounts, and increased personal information requirements. The junta has deployed uniformed military personnel to all banks to monitor any transaction over $40.

The junta’s control over the mobile banking system in particular curtailed the Spring Lottery, the NUG’s first attempt to raise revenue. Not only was the Spring Lottery meant to raise a steady amount of funds on a monthly basis, it sought to deny the regime revenue from their own lottery.

The real challenge: moving Funds

The NUG has acknowledged raising over $150 million since the coup. It has rejected any involvement in illicit narcotics, despite the fact that they are pouring out of the country in record amounts.

Though it dwarfs in comparison to the revenue of the junta, which gave itself a raise of 51 percent in FY2023 to $2.7 billion - it’s not insignificant either.

The NUG has raised funds through the auction of military owned property and land preemptively seized under eminent domain, crypto bond sales, mining rights, and potentially shares in military-owned corporations. All of this possible through their FINTECH savvy.

These are a leap of faith for any purchaser or investor. The bonds are zero coupon and will only be redeemed if the opposition wins. The property and corporate shares are theoretical: No construction or land transfer happens should the NUG fail to defeat the junta. But people are fueled by patriotism and a vitriolic hatred of the military.

For the NUG, the harder task is moving raised funds through crypto currencies and turning it into usable resources to buy weapons and ammunition. The crypto bonds are issued in the Czech Republic, but the Prague government limits the NUG’s access to the banking system.

Aside from the military’s control over the banks, moving funds is not easy due to the post-9/11 international banking environment and the October 2022 Financial Action Task Force blacklisting that increases oversight on financial transactions in and out of Myanmar.

In mid-2022, the NUG established a mobile wallet system, NUGPay, to try to circumvent the formal banking system. The app had mixed results. It required a network of licensed brokers, around the country and world, who could take foreign exchange or Kyat and turn it into the digital Myanmar Kyat (DMMK) tied to Tether, a U.S. dollar-denominated stablecoin.

While it made donations from overseas easier, widespread internet outages and the physical danger for licensed agents in Myanmar limited its use as a currency. Even being caught with the NUGPay app on one’s phone can lead to a prison sentence.

Despite the limitations, over $30 million in DMMK are currently in circulation.

Full-service online banking

To overcome the shortcomings of NUGPay, the NUG’s Ministry of Planning, Finance and Investment developed a full-service online bank that will open in several phases, starting in August.

The bank is legally registered in a third country (unnamed for security reasons) and is under the oversight of the NUG’s interim Central Bank, which was established in June 2023.

The Spring Development Bank (SDB) will provide for-profit banking services that include savings accounts, gold purchases, remittances, a long-term investment fund, and foreign currency exchange.

It is accepting deposits in U.S. dollars, Singapore dollars, Thai baht and Myanmar kyat. It will expand its currency offerings to the Euro, pound, Japanese yen, and Korean won in the future.

In its second phase, it will issue its own coin for investors and provide credit cards and a merchant payment system.

As important, SDB will also serve as a one stop outlet for the purchase of bonds, lottery tickets, auctioned real estate, and in the future, shares in military-owned corporations. Thus it is a way for the NUG to raise funds in a regular and streamlined fashion, with proceeds going directly into NUG accounts.

SDB has already received the attention of the military government.

In June 2023, a Vietnamese IT company established a mirror site to the Spring Development Bank, using the same graphics and interface, an apparent phishing expedition to get the names and contact information of people trying to sign up, in order to arrest them and deter others.

Hacking and disruption

The NUG is expecting a concerted effort by the military government to hack into the bank and disrupt NUG finances. The bank is based on block-chain technology on the Polygon Network.

SDB has a number of other hurdles, including getting widespread use when the military continues to shut down the internet in large swaths of the country. The goal is to have 100,000 customers within the first six months, and 500,000 within a year.

The bank will have an important role for the provision of government functions. Union ministries will have accounts and be able to fund their operations at both the federal and local level; it will assist in tax collection, now being done in 32 of 330 townships.

Most importantly, it will allow foreign donors, whether governments, NGOs, or multilateral economic institutions directly support the NUG’s civil administration and provision of humanitarian aid.

With the motto “Real Bank. Real Freedom,” the Spring Development Bank, is yet another tech savvy innovation from the National Unity Government that is laying the financial foundations for a protracted war.

But it's also laying the groundwork for the country's future financial system. Myanmar-Now reported that with a diminished tax and revenue base, the military government has been forcing both state-owned and private banks and insurance companies to purchase bonds to fund the war effort, to the tune of up to $8 billion since the coup.

That is a staggering figure, even if it’s less than reported. According to the World Bank, Myanmar’s GDP was $59.3 billion in 2022, 12 percent below the pre-coup figure.

The junta has used its Central Bank as a piggy bank to support the war, not as an independent body to provide macroeconomic stability. It seems unlikely that the regime will ever fully redeem the bonds when they mature, leaving already distressed banks even further indebted.

What should be assets on their balance sheets are nothing but liabilities, and the NUG has made clear that these issuances are illegal and will not be honored.

That might make the Spring Development Bank, not just essential for the establishment of a federal democracy, it might also make it the most solvent bank in the country.

Zachary Abuza is a professor at the National War College in Washington and an adjunct at Georgetown University. The views expressed here are his own and do not reflect the position of the U.S. Department of Defense, the National War College, Georgetown University or Radio Free Asia.